One of the biggest reasons people trade options is to get that fantastic leverage where you can risk a few dollars to possibly make a fortune.

Pretty exciting.

The problem is–options–and the stocks they are traded on–are sometimes like teenagers–they don’t always do what you want them to. Most folks start off buying cheap options on hot stocks because, goodness–you can make SO MUCH MONEY! But a funny thing happens on the way to depositing your mult-thousand dollar windfall. The Fed makes some announcement–or earnings were good and the stock should have rocketed higher–or the pattern was perfect until it wasn’t–or whatever. And you lose all your money. Again.

DAMN! And THAT My Friend, is Why Options Have a Bad Name.

But redemption is at hand–in the form of this short little article.

Do this one little thing I’m going to show you–and you will make options your lifelong friend.

And you’ll never have to worry about volatility again.

Two big promises right?

Yes indeed. So let’s get started…

To truly harness the power of options and to make them your lifelong rich and generous friend you have to understand them. Understand their motivations. Learn what makes them do what they do.

Sounds like good advice for any significant other, right? But what could be more significant than that your potential escape vehicle? The one that can break the chains of wage slavery for life.

Without going all ‘Greek’ on you, let’s just say the two most important drivers for options aside from the obvious–which is the movement of the underlying–are Volatility and Time Value.

Volatility literally determines the time value of an option–and sometimes that’s all the value there is. In times of high volatility options can get very expensive. And in times of low volatility they can get very cheap. It just depends on what is coming (earnings perhaps?) or what just happened (the EKG went haywire).

But through thick and thin the one thing you can DEPEND on with options is time decay. At some point or another–no matter how much time value is priced in right now–all the time value of that option is GUARANTEED to disappear.

You don’t get many guarantees in trading, but this is one of them. It’s how options are built–it’s what makes them different from stocks. And like they tell us now–we need to learn to celebrate our differences.

So Let’s Say We Don’t Know Much–but We Know These Two Things. Now What?

Let’s build a strategy off these two things–because when it comes to options characteristics we can count on them–no matter what.

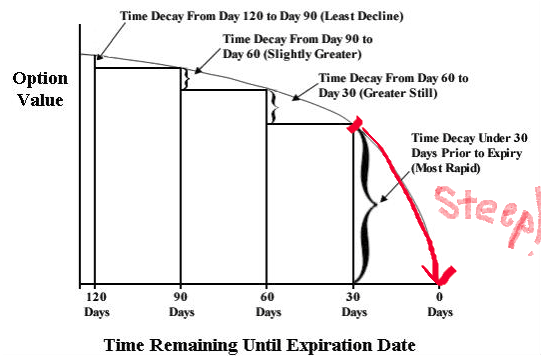

First of all let’s hit the one absolute known–time decay. If everything else stays the same the time value of your option will decay every day–but here’s the kicker–it doesn’t do it in a straight line.

The big takeaway from this graph of time decay is how steeply time value declines once it becomes front month. And then notice how the time decay just accelerates almost straight down the closer the option gets to expiration.

File that away in your reptile brain because this one little tidbit can make you a lot of money.

So here’s a concept–instead of buying short term options hoping something nice will happen–and then getting crushed when it doesn’t–how about we SELL those options instead?

How to Use the MACD Indicator

New PDF training guide explains the pillars of successful technical trading. Like how to understand common chart patterns, candlestick signals, stochastics and more.

How About We Jump on the Winning Side for a Change?

The awesome thing about selling short term out of the money options is you have the biggest characteristic of options working for you–time decay.

If you haven’t done this yet you might be shocked at how many times it works in your favor–even if your stock direction guess-work is a little off.

But rampant success using this strategy is no accident–the options pricing model–you know, the one that won the Nobel Prize in 1998 for the mathematicians that discovered it–predicts you’ll win most of the time.

Without going into actually probabilities let’s just make it really simple by looking at the five things a stock can do. A stock can 1) go up dramatically, 2) go up gradually, 3) go sideways, 4) go down gradually, or 5) go down dramatically.

Selling short term out of the money options–we recommend selling credit spreads so you always have a hedge–allows you to win on four out of five of things a stock can do. In fact the ONLY way you can lose on selling the 165 calls, in this case, is to have the stock go up dramatically.

So just a rough calculation tells us that if you have a 4 out of 5 chance of winning you have about an 80% chance of winning. However the poor soul that bought that option only has about a 20% chance of winning because–as the options pricing model tells us–the two are the inverse of each other, and the total sum has to equal 100%. Sounds Good So Far–But… If you’ve had some experience selling options you might be thinking–”Yeah right, that works great right up until you have some explosion in price that takes out your sold option at a huge loss!”

And to that I’d say you are right. So how do we work around that?

Now we are getting into volatility–that other great driver of options pricing–AND the subject of this little treatise.

Because anybody that knows anything about selling options knows that if you sell in front of some huge volatility it’s kind of like jumping on top of a hand grenade. Which is especially troubling if you’re not actually saving all the other guys in your platoon’s lives and they won’t even be able to inscribe something noble on your tombstone.

So let’s just not do that. So how can we harness the incredible options pricing power of volatility AND safely make money on it? Well our little solution has to do with our old friend John Bollinger down in Los Angeles–a financial analyst that did us all a big favor. Bollinger Bands are intervals drawn on a price chart that define high and low on a relative basis. Bollinger started developing Bollinger Bands way back in the early 1980s.

He was trading options at the time and much of his analytics involved volatility. At the time only fixed width trading bands were used. Bollinger’s contribution was to use volatility standard deviation to make trading bands dynamic and adaptive.

When Bollinger first introduced the concept to the public on the Financial News Network in L.A., they had no name (I used to speak on that show all the time in the late ‘90s until they turned it into an all-Mexican station). During the program, the interviewer pointed to the bands and inquired as to what they were; Bollinger replied “Let’s call them Bollinger Bands.” Hah! Snuck in a little history on you when you weren’t looking. Great Story–But What’s All This Have to Do With Making Us Money?

Glad you asked.

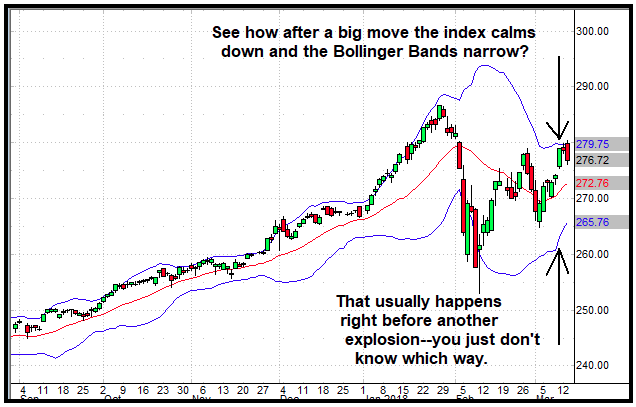

So one of the ways traders use Bollinger Bands is to look for little ‘necks’ where the bands get close together because they almost always preclude an explosion in volatility–it’s just that nobody knows which way.

Here’s what we’re talking about:

So you see the narrowing of the Bollinger Bands and you know there is likely another big explosive price move happening soon–but without knowing which way you’d be crazy to sell credit spreads–or any options selling strategy–in front of what could be a dramatic price move. So you don’t.

You wait for the explosion you know is coming because you’ll get two awesome advantages out of it if you do… The first is that any big move in the underlying really juices the options time premium–and since that’s exactly what you are selling you rake in a relative fortune. Nice. Secondly once the explosion happens you KNOW which way it’s going to go because it just did. Plus oftentimes the move has just about exhausted itself by the time you sell so you don’t have to worry much about having your option over-run. Here’s what we’re talking about:

As we can see the time to sell a credit spread is when the Bollinger Bands have gotten to their widest point and now they are starting to contract again–that is absolutely the safest time to sell.

Plus the stock or index is by definition over-extended–it’s gotten too far from it’s mean. The blue lines on the chart show two standard deviations from the mean–or the red line–that’s the standard Bollinger Band setting. So that tells us the underlying is already getting a little too stretched and ready to snap back–AWAY from your newly sold spread.

Which is of course exactly what we want.

So We Are Combining the Two Most Powerful Drivers in Options to Make Money While the Markets ‘Go Crazy’

Actually to be accurate we’re actually making our bets once the markets start to calm down–but the key here is, they always do.

And usually it doesn’t take too long.

Look at this chart of the VIX.

As you can see volatility can spike sharply higher–but it never lasts. Which makes selling volatility spikes one of the safest and most consistent strategies out there.

And that’s what we’re doing when we sell wide Bollinger Bands.

So Take This Little Strategy and Use It to Make a Fortune–In Fact I’ll Even Help You Do It

Combining these two little strategies are just one of the tricks I’ve learned over the past twenty years to sell premium with a ridiculously high probability of winning. I’ve got a whole bunch more of them that when used in combination make it extremely hard to lose.

It happens mind you–just not that often.

And that’s just the way we like it. I’ve taken thousands of options traders–and traders from other asset classes as well–that are tired of losing money and converted them with a few simple strategy changes into life-long winners.

And I’d like to do the same for you.

Not only that but these are strategies can literally be put on auto-pilot–you you don’t have to spend all day fretting over your trades like a Mother Hen.

That Means You Literally Have the Best of Both Worlds–a Growing Income and the Time to Enjoy It

THE SPECIAL OFFER

A fairly passive, high probability, two-week turn strategy is literally the best of both worlds. The income grows fairly quickly because the turn time is fast and drawdowns are small if you follow some simple rules. And since I’ll show you how to set automatic exits if your trades are threatened you don’t have to constantly monitor your trades–so you can literally do this while adventuring anywhere in the world you can get an Internet connection. To really make this work for you there is an extensive educational package waiting for you combined with a comprehensive Tuesday night update that tells you exactly what to sell and where to sell for maximum profits with minimum risk. And you’ll get follow-up on those trades as well so you’re never left guessing. Plus you’ll even get emails and texts on your trades during the week if necessary. I think you are really going to like it–mainly because it’s the highest odds of winning set of strategies out there. And that’s not just one guy’s opinion–it’s built right into the probabilities of the options pricing model. To gain access to a special all-inclusive package I’ve put together just for readers of this book, click on the button below.

ABOUT THE AUTHOR

Author: Peter Schultz, Founder

Author: Peter Schultz, Founder Company: Cashflow Heaven Publishing

Website: CashflowHeavenPublishing.com

Services Offered: Trading Courses, Coaching, Weekly Advisory Newsletter

Markets Covered: Stocks, Options

Peter has been showing self-directed investors how to trade successfully since 1996, and is a nationally known speaker on options trading, the author of Passage to Freedom, The Options Success Trading Package, The Winning Secret Trading Package, The Explosive Profits Package and The Greatest Options Strategies on Earth.